Introduction

Skid steer loaders are making an essential place on construction sites. With time, advanced features are being invented in different construction machines. However, sometimes the quality of these machines disappoints you after they stop working. Therefore, buying your construction equipment from the right place is quite essential.

You may choose a local brand or international brand to choose your machines. But you should never miss China when importing from other countries and choosing a global brand. China is known as the largest exporter of goods.

This article will give you an in-depth guide on importing your skid steer loaders from China. But it is essential to learn about some importing terms before knowing the import process.

Let’s dig into the article.

How Did COVID Impact the Importing Process From China?

Covid-19 has impacted different businesses across the globe. The lockdown situations and fast spread of covid have affected businesses and hence the economy of other countries.

It led to the worst case, resulting in the closing of companies and the banning of the importing process. Even if there was an import process, it cost too much due to extra precautions during covid.

Impact on Taxes and Import Duties

After analyzing the situation, covid didn’t impact much on tariffs, taxes, or import duties. Instead, it resulted in increased freight costs. Even the United States Of America has maintained the Trump-era tariffs on imported goods during the Covid period. And it is a fact that change in freight costs also impacts tariffs, taxes, and import duties.

An increase or decrease in freight costs is directly proportional to the import duties of the products. Like many other products, skid steer loaders also got higher import duties due to increased freight costs. Before moving towards some important import terms, let’s know why you should import from China.

Benefits of Importing SSL From China

You may also purchase a skid steer loader from your own country, but why do experts recommend importing it from China? Well, knowing the benefits of importing your construction equipment from China are listed below:

- Reduced costs

- High-quality products as compared to other Asian countries.

- Customizable products

- Order in bulk amounts is easy

- Proper quality control and testing process to check the quality.

Risks of Importing Skid Steers From China

Even if there are amazing benefits to importing skid steer loaders from China, there can also be risks and disadvantages. Before making a purchase or deciding on something, you must know both sides, i.e., the pros and cons. Let’s dig into the risks of importing your skid steer loaders from China:

- Facing fraud or scams from the manufacturer’s side.

- Receiving a broken or damaged product.

- Receiving the wrong item or model of skid steer or getting the one that doesn’t work correctly.

- Not being able to get after-sale services after receiving the product.

- The complex process of making a purchase. (but it is worth it once you understand the process).

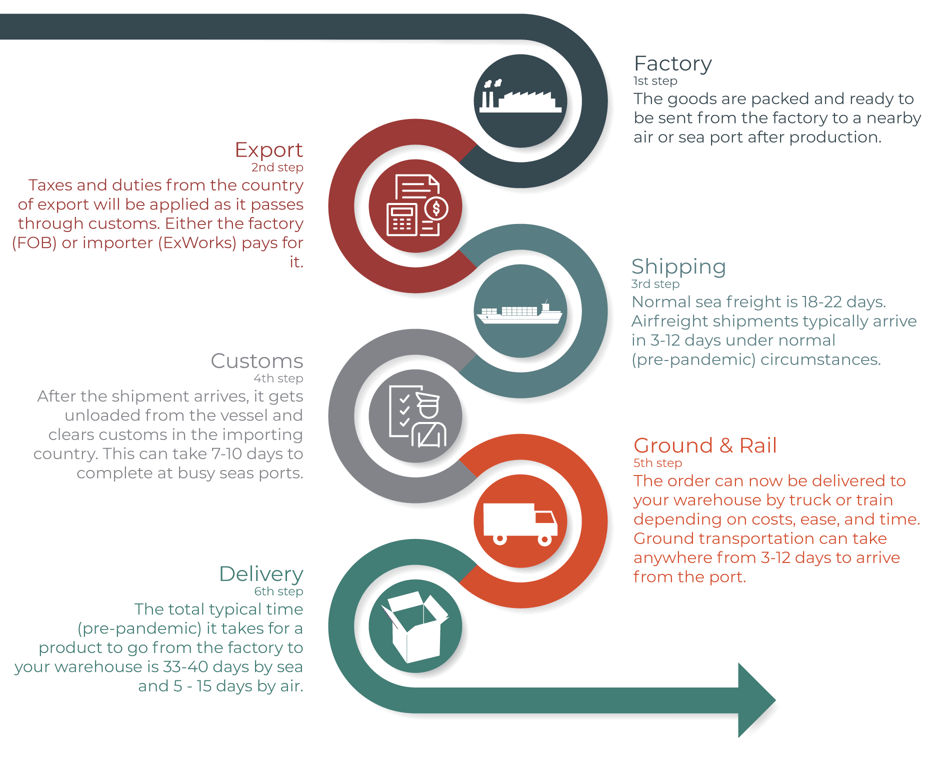

Step-By-Step Process to Import From China

Let’s get an idea of how you can import your skid steer loader from China.

- The first and most crucial step is to know your requirements. You must know which size, features, specification, weight, attachments, and model you want for your skid steer loader.

- Secondly, you must know the budget that you can afford for your SSL. Then, choose a supplier within your affordable budget.

- Make a list of China’s best manufacturers and suppliers of skid steer loaders.

- Visit their website and online stores to check their products, reviews, models, features, experience, and prices.

- Ask for advice from your fellow importers, colleagues, and friends.

- Make a list of recommended manufacturers.

- Contact them one by one and have a discussion on products, prices, features, etc.

- Note each and every detail on a piece of paper or notepad.

- Choose the manufacturer that fulfills your requirements within your affordable budget.

- Contact an importing agent to help you import your SSL to your country.

Choosing the Right Manufacturer or Trading Company

When you are purchasing your skid steer loaders or any other construction equipment, you should know it. You must know whether to purchase from a trading company or a manufacturer. Manufacturers can offer you low prices and quality depending on their raw materials, customization, and bulk amount.

On the other hand, trading companies don’t manufacture the products by themselves. They take parts of the products from different brands and assemble the parts by themselves.

Trading companies are good if you want to purchase low-quantity products because they are more expensive than manufacturers. The quality f trading companies depend on the quality of the parts they buy.

But there are fewer customization options available for trading companies. Therefore, buying from manufacturers might be beneficial.

Analyzing the Quality of Skid Steer Loader

Analyzing the quality of your construction equipment is easy when you make a purchase from your own country. But complications may occur when you are buying from another country, such as importing from China. Here are the most straightforward steps to ensure the quality of your skid steer loader:

- Ask your supplier to come on a video call and have you visit his factory online.

- Ask him to show you the demo of products online and the manufacturing process.

- Check for his reviews on online stores.

- You must check your company’s customs data and license before finalizing the deal with them.

Payment Procedures

You should never forget to ask about the payment methods that your manufacturer accepts. But make sure that the budget of your skid steer loader is affordable. Most people forget to negotiate payment procedures and budgets. It results in problems when delivering your skid steer loader.

- The LC method is mainly applied to payments when ordering a small item.

- The open Account (OA) method is also applicable, but this is not chosen when ordering in small quantities.

- TT method is also popular, taking 30% advance payment and 70% after the delivery of products.

- Don’t make an order in bulk amount when you are ordering for the first time.

- Find yourself a reliable cargo agent.

- Ask for reviews of your selected company from others manufacturers in China if you made a deal with them in the past.

Pre-sale and After-Sale Services

The best manufacturer is the one that gives you quality pre-sales and after-sales services. Pre-sale services might include drawing or sketching your product. At the same time, after-sales services might include shipment, repair, and guidance for your products.

Customization of your products also comes under the pre-sales services. Make sure you get the guarantee of the product in the after-sales service.

Now let’s dig into the taxes, import duties, and custom values for importing your products from China. These are applied after finalizing your skid steer loader from the manufacturer.

RCEP Countries Import Duties

RCEP is an abbreviation used for regional comprehensive economic partnership. Fifteen different countries agreed on free trade, which is known as RCEP. Among the 15 countries, five are Korea, Japan, China, New Zealand, and Australia. At the same time, the other ten countries belong to the Asian region.

Importers from RCEP countries enjoy zero taxes or tariffs. Different RCEP countries lie in the neighborhood of China. Therefore, they benefit from the free trade process.

USA Import Duties

A custom value of $200 is applied when you import your skid steers from China to the USA. The value may vary depending on the product that you import. For example, European Union has different import duties for agricultural products. When importing your skid steer loaders from China.

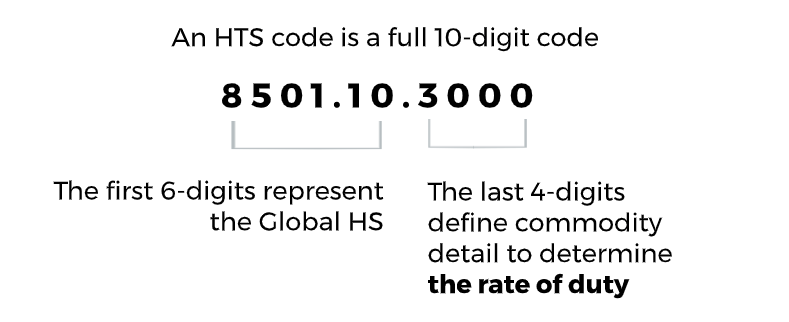

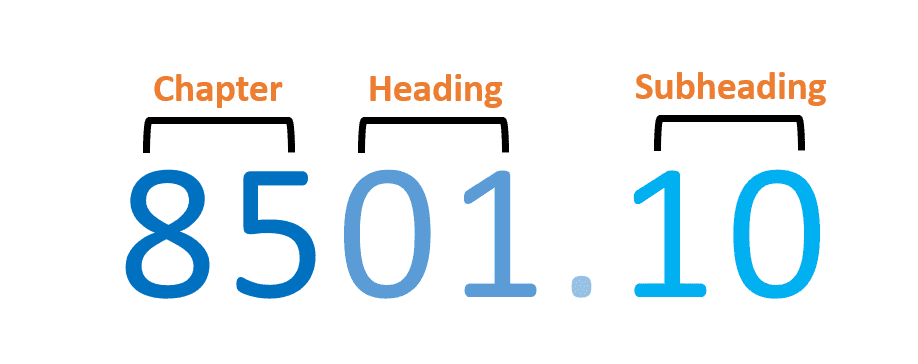

Harmonized Tariff Schedule

Harmonized tariff schedule or HTS helps calculate the import duties for your skid steer loader. You must know that China offers 3 to 25 percent import duties for most products, but HTS can help you calculate the accurate amount. It is actually the name of a document that different countries use to figure out import duties worldwide.

Merchandise Processing Fee (MPF)

MPF is another crucial concept when you import your SSL from China. You must pay a merchandise processing fee when importing from China to the USA.

MPF is divided into two main categories. It is $2 to $9 per shipment for a product worth $2500. While it is 0.3464% for products having cost more than $2500. MPF lies in the range of $25 to $485.

Harbor Maintenance Fee

The Harbor maintenance fee is paid when you have the shipment of the skid steer loader via sea. The primary purpose of HMF is to have the maintenance cost of the container in which your skid steer loader is placed. It constitutes only 0.125% of the cargo value.

Additional Taxes

VAT is also an important term when you are importing from China. But the best part to know is that USA importers don’t have to pay VAT. VAT is charged on products like alcohol and tobacco. So you don’t need to pay for products like skid steer loaders or excavators.

Customs Value

Like HMF and MPF, you also need to pay custom value. But these values are calculated based on FOB costs. FOB stands for free-on-board costs that include the following parts:

- Chinese export clearance

- Transportation costs

- Product costs

You must know that different suppliers or manufacturers of skid steer loaders give you the cost based on FOB costs.

Importing Skid Steer Loaders to European Union

You must know that the European Union consists of multiple member states. Therefore, the import duties for the European Union are the same across all member states. EU is more like a single market. So if you import skid steer loaders from non-European countries, you pay custom value once for the SSL.

The best part is that there are no import duties on products sold within the EU region.

Import Duties on European Union

The import duty rates may vary from product to product and state to state in the European Union. The products that are not produced in the EU can have import duties as low as 0%. Moreover, if you purchase products from any popular industry, they may also have 0% import duty rates.

Value Added Tax

VAT (Value added Tax) is an essential term across the European Union. But different member states possess different rates of VAT in the European Union. However, there is a standard rate of VAT that you pay for consumer and industrial products. You must know that VAT is added on top of custom values for a skid steer loader.

The import duties of skid steers are also based on custom values. The VAT charged on your imported SSL is treated as the VAT charged on SSL purchased within the EU. Hence, it can be offset against the VAT on sales.

Custom Values In the EU

Custom value in the EU market is based on CIF. CIF is an abbreviation for cost insurance freight of the imported SSL. The customs value of your imported products in the EU region includes the following costs:

✔Insurance price

✔Tooling costs

✔Product cost

✔Logistics and shipping costs

✔Development costs of the product

Costs that are not included in customer value are:

✔Transportation Costs in the importer’s country

✔Fee and commission

✔Costs at the destination port

You must know that the customs authorities will never give you the total estimates. All the declared costs are written on the Bill of Lading. It is a document given by your supplier, manufacturer, or freight forwarder.

Your supplier must declare the right costs. Otherwise, you may end up paying the wrong amount.

Importing SSL From China to Canada

Canada being the largest English-speaking country, have some complex rules for taxes and imported products. If you live in Canada and have to import construction equipment, you must pay three types of taxes. These are:

- Provincial Sales Tax (PST)

- Goods and Services Tax (GST)

- Harmonized Sales Tax (HST)

But the best part to know is that no Canadian state has to pay all these three taxes. One or Two of them are applicable in each state of Canada. For example, the GST tax is applicable in Alberta, but it doesn’t have to pay the other two taxes. The same rule is applicable in different states of Canada.

The best part to know is that there are reduced import duties for underdeveloped countries.

Custom Values

These values are based on free-on-board costs. But shipping costs are not included. As a result, you get low duty rates. But you must pay costs like tooling, product sample, and service costs in Canada.

Importing From China to Australia

Australia is known for low import duty rates as compared to the United States of America and the European Union. The economy of Australia is not dependent on industrial sectors like many other countries.

Free Trade Agreement-2015

The free trade agreement makes the import duties 0% on many products imported from China to Australia. 93% of products are imported with no tariffs. But there is a GST that you must pay when importing a skid steer loader from China to Australia.

Goods and Services Tax on Products

Now when it comes to GST, you need to pay 10% in addition to insurance, import duty, custom values, and transportation costs. This rule is applicable to every product you import from China to Australia.

Import Processing Charge Costs

Import processing charges are applicable on products costing more than $1000 in Australia. But it depends on three factors given below:

✔The Transportation Mode

✔Customs Value

✔Import Declaration Type

Import processing charge costs are applied to every product imported from China. But it lies in the range of AU$40 to AU$50.

Customs Value

The customs value is based on FOB costs that include the following costs:

✔Costs of Transportation

✔Export clearance

✔Costs of Product

Importing From China to the UK

United kingdom lies in line with the EU region. It has some of the following rules:

✔You must pay import duties on most products imported from China.

✔You must pay VAT for your products.

✔Custom values are finalized based on insurance, product, and freight costs.

✔According to the prediction of importing agents, the tariffs and VAT rules may vary from the EU region in the near future.

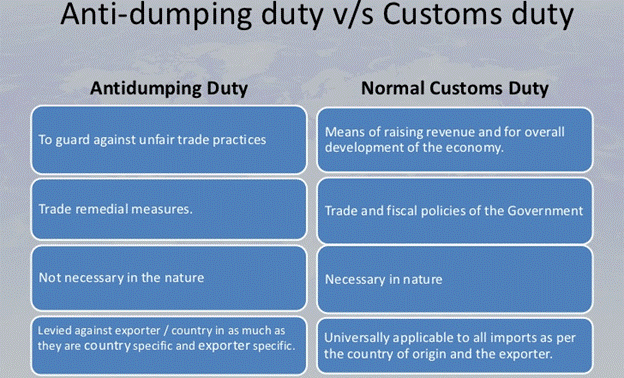

The Anti-dumping Duties

China’s government provides subsidies to specific industries, suppliers, and manufacturers. As a result, the suppliers may sell their products at a low cost.

But since the Chinese government rules didn’t get the favor of the EU and the US, it resulted in Anti-dumping duty measures. These measures target whole industries or individual manufacturers and suppliers.

The range of anti-dumping duties is 40% to 60%. Make sure that anti-dumping duties are applicable to your imported products or not. The Chinese government is not responsible for duties and taxes outside the Chinese boundaries.

Declared Value

The taxes and import duties are calculated based on custom values. At the same time, the declared value tells you the custom value. You can find the declared value on the commercial invoice.

HS Codes

HS code helps you to classify your product. It makes the process easier for customs officers to check the carton. Hence, the process becomes time-saving. But you have to ensure that there is an HS code on your commercial invoice. Otherwise, you may end up paying import duty for the wrong carton.

Payment of Taxes and Import Duties

After learning about all the important import terms, now you may think about how to pay for them. Well, there are different ways to pay taxes and import duties.

-

Pay import duty rates to the freight forwarder.

- Simplest method

- Custom officers charge based on HS codes and declared value at the port.

- May charge $40 to $80 for your customs declaration.

-

Apply for custom credits and pay the taxes.

- Through local customs authorities.

- Deliver the product first and pay the taxes later.

-

Buy a DDP(Delivery Duty Paid) from your supplier.

- An agreement between purchaser and supplier.

- Includes import duty rates and customs duties.

- It doesn’t include GST and VAT.

Import Duties Are Refundable or Not?

Import duties are never refundable. A refund of VAT is possible, but not for import duties. It is more like a part of your products’ cost. Import duties can vary from 0% to a considerable rate. Therefore, you should make sure you can afford them.

Repaired Attachments or Replaced Parts Import Duties

You must be happy to know that there are no import duties on replaced parts or repaired attachments. You may want to replace the products or send them for repair in China. Import duties don’t apply in both cases. But make sure to notify your freight forwarder or customs broker before you ship the product.

China Has “Paid” Taxes and Import Duties or Not?

You don’t have to pay taxes in China when you are importing anything to your country. These costs that are charged in China are included in FOB costs. You need to pay shipping and exporting costs if you buy from a supplier with ex-work terms.

You have to pay for the shipping of your product from the factory to the loading destination. This payment is not affordable for many.

Therefore, purchasing at FOB terms and not EXW terms is recommended.

Reduction of Import Duties and Taxes

You can easily reduce the taxes and import duties after understanding the customs values. The complete amount is finalized based on the declared value. But it is an illegal and risky practice that might lead you to jail. You can reduce the taxes by only exploiting some trade rules.

Liability for Payment of Taxes and Import Duties

Since you are the importer of skid steer loaders from China to your country, you are liable for the whole process. You must take the liability of paying all the taxes, import duties, VAT, GST, etc.

So Are You Ready To Purchase A Right Skid Steer Loader From A Reliable Manufacturer? Contact Us Now to Get a Quote For Your Construction Equipment.